When to claim Social Security is a very important and personal decision. This decision is also permanent and could mean losing out on many thousands of dollars in benefits over your lifetime. Don’t let these common myths, mistakes and misconceptions negatively impact your Social Security claiming decision.

- Social Security is going to run out of money! This is the biggest concern for everyone by far. And, according to the Social Security Agency FY 2024 report, this is true. Their math says that Social Security’s reserves will be depleted by 2034. On the other hand, this is not the full story. If workers are earning wages, then 6.2% of those wages (up to $168,600 for 2024) are withheld towards Social Security. Employers also have the same obligation to contribute towards Social Security. Therefore, Social Security will still be able to pay benefits. Simply put, the revenue coming in from payroll taxes will be used to cover those benefits going out to retirees. Current estimates are that 79% of Social Security benefits would still be covered after 2034. While this is less than 100%, this gap is essentially a solvable math equation. Congress will at some point need to make changes – such as pushing back the Full Retirement Age (FRA), raising payroll taxes, potential means testing, etc. Knowing this, it may then be prudent to modify Social Security benefits incorporated into your cash flow to approximately 79% of your projected benefit.

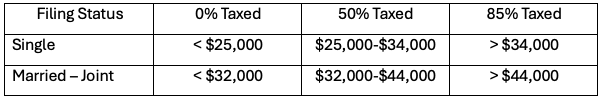

- Social Security benefits are not taxed. Unfortunately, many individuals are subject to taxation on their Social Security benefits. Your benefits will be taxed if your “combined income” exceeds certain thresholds. Combined income is the sum of your adjusted gross income (AGI), plus tax-exempt interest income and half of your Social Security benefits. See the chart below for how much of your benefits are taxed based upon your combined income levels.

These thresholds have not been adjusted for inflation so over time more of your Social Security may be taxed. In addition, you may also pay state income taxes on your benefits if you live in one of the 10 states that tax Social Security.

- Claim your benefits as soon as possible. With all the negativity surrounding Social Security many believe that they should just claim as soon as possible to get what they can from Social Security. Age 62 is the earliest age you could claim, but this decision comes with a substantial reduction in your future lifetime benefits. There is approximately a 6% reduction in benefits for every year prior to your Full Retirement Age (FRA) that you begin to receive your benefits. For example, if your full retirement age is 67 (born in 1960 or later), then your reduction would be 30% (5 years before FRA x 6% per year reduction = 30% reduction in benefits). If your benefit at FRA was expected to be $30,000 ($2,500/per month), then this 30% reduction means you would lose out on $9,000 per year. The reduction over the course of say 20 years (without any cost-of-living adjustment) means forgoing $180,000 of income. This is a significant amount of income which underscores how important a choice this is. However, if you believe your life expectancy will be cut short, then taking your benefits before full retirement age may make sense.

- Not considering your spouse. Another big mistake often made in claiming Social Security benefits is not considering your spouse. If you have a spouse with a lower Social Security benefit, then it might make sense for you to delay your benefit as long as you can so that in the event of your passing, your spouse would be able to increase their benefit equal to yours. In other words, they would get the higher of the two, but not both. This is particularly important because your death may mean a loss of income for your surviving spouse for many years – even decades.

- You lose Social Security if you continue to work. This is a common misconception. You can still work and receive benefits, but there are a few points to consider. If you are under your FRA, then earning more than $22,320 (2024 limit) means that for every $2 you earn above this limit, $1 in benefits will be withheld. The year you reach FRA, $1 is withheld from your benefits for every $3 you earn above $59,520 (2024 limit) until the month you reach FRA. After you have reached FRA, you can earn as much income as you want without any benefits being withheld. Note the language used here, “withheld” because you are not losing your benefits. If some of your retirement benefits were withheld because of your earnings, your monthly benefit will increase starting at your FRA. The Social Security Administration recalculates your benefit when you reach FRA.

Claiming Social Security benefits can be deceptively simple. Weighing your options and avoiding the influence of common myths and misconceptions will help you make an informed decision that maximizes your Social Security benefits.

All written content is for information purposes only. Opinions expressed herein are solely those of Stinnett Wealth Planning, LLC unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant, or legal counsel prior to implementation.

These thresholds have not been adjusted for inflation so over time more of your Social Security may be taxed. In addition, you may also pay state income taxes on your benefits if you live in one of the 10 states that tax Social Security.

These thresholds have not been adjusted for inflation so over time more of your Social Security may be taxed. In addition, you may also pay state income taxes on your benefits if you live in one of the 10 states that tax Social Security.